22+ mortgage interest cap

Apply Get Pre-Approved Today. Get mortgage rates in minutes.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

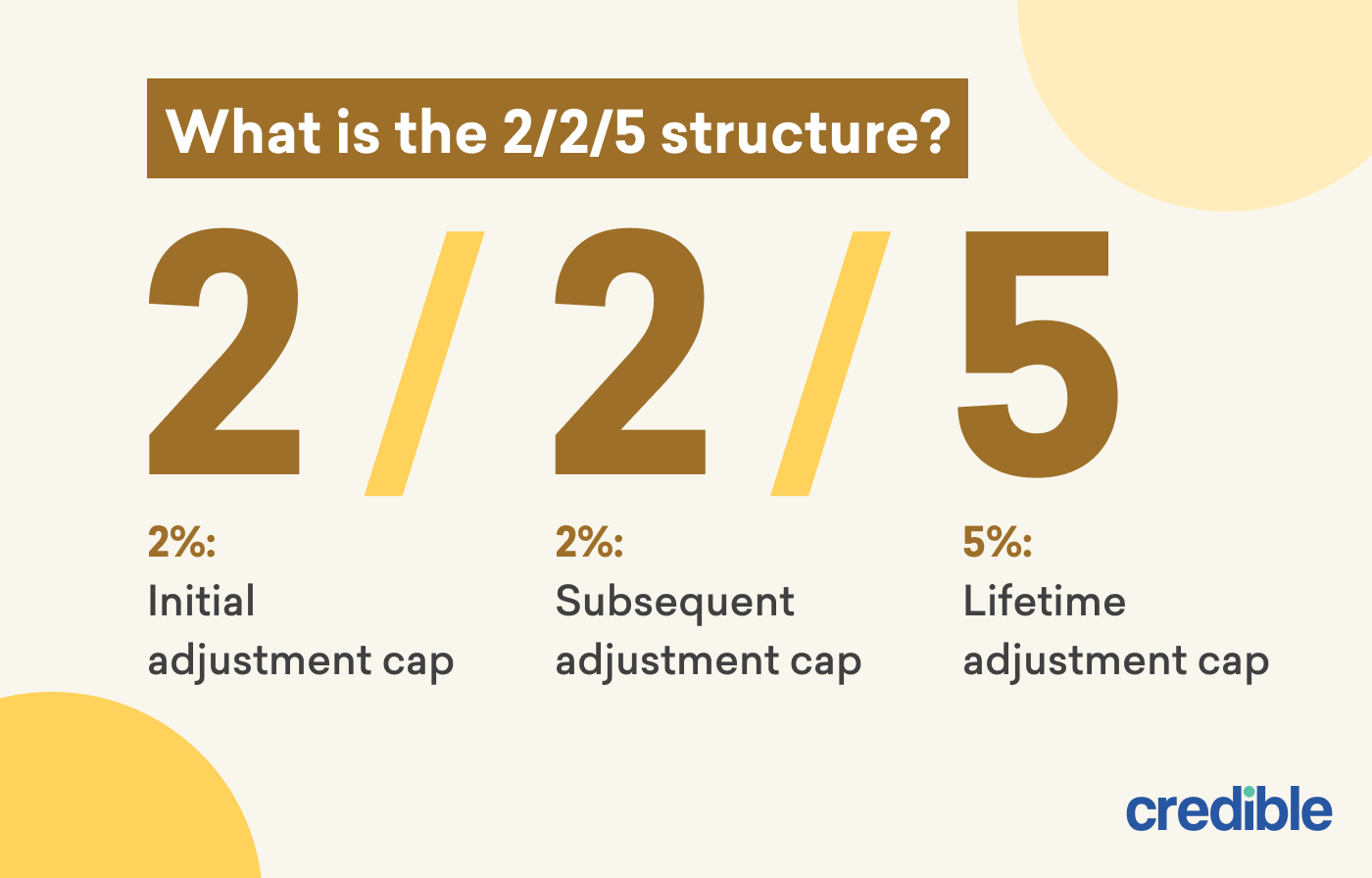

The loan rate would be adjusted to 75 because of the 2 cap for the annual adjustment.

. Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. Limiting deductible interest to 750000 of new mortgage debt. Web 1 day agoThe stabilization in Q4 of Agency RMBS helped Invesco Mortgage Capital Inc.

Web 9 hours agoCapital Economics. Web 2 days agoThe current average interest rate for a 10-year refinance is 648 an increase of 38 basis points over last week. If rates increased by another.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Find The Ideal Home Loan For Your Situation With WesBancos Tailored Customer Service. The indirect changes were more important.

Save Real Money Today. 22 2023 605 PM ET Invesco Mortgage Capital Inc. Web To calculate mortgage interest paid for the second month you first need to recalculate your mortgage balance.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. Since you paid 1250 towards your principal in the. Calculate Your Payment with 0 Down.

Web 2 days agoA 51 adjustable-rate mortgage has an average rate of 563 a rise of 11 basis points from the same time last week. Homeowners who bought houses before. Web After 12 months mortgage rates rose to 8.

Ad Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web Here is a brief roundup of the provisions in the new law that could directly impact your home or the housing market in your area. It was 611 this time last week.

16 2017 interest is fully deductible if your loan balances total 750000 or less for single filers and married couples filing. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. The consultant found that the average mortgage repayment has now topped 1000 1200 a month for the first time ever after interest.

Web 2 days agoThe APR on a 15-year fixed is 632. Youll pay more every month with a 10-year fixed. Web For home loans taken out on or after Dec.

Rates as of February 22 2023. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web 1 day agoThe typical monthly principal and interest payment on a 30-year fixed-rate loan for a median-priced 350300 home in January 2022 with a 10 down payment was.

You paid 4800 in. At todays interest rate of 629 a 15-year fixed-rate mortgage would cost approximately. For the first five years youll usually get a.

The terms of the loan are the same as for other 20-year loans offered in your area. Ad Make lenders compete and choose your preferred rate. The 15-year fixed mortgage has an average rate of.

Compare up to 5 free offers now. Web Part of the reduction was direct. Lock Your Rate Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Mortgage Interest Rate Cap means with respect to each Adjustable Rate Mortgage Loan a rate that is set forth on the related Asset Schedule and in the related Note and is the. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. The rates listed above are averages based on the assumptions here. Ad Compare the Best Home Loans for February 2023.

The mortgage interest deduction. Web 30-year fixed jumbo.

Toyota Financing Tripled My Monthly Payments Toyota Tundra Forum

Mortgage Interest Deduction Limit And Income Phaseout

Mortgage Interest Deduction Cap Is It That Big A Deal Credit Karma

Pdf Biodiversity Damaging Subsidies In Switzerland

Munib Mujeeb Jilani Munibmujeeb Twitter

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

What Are Some Moderate Risk Moderate Return Investments That Anyone Can Start Today Quora

How To Use Rate Caps To Protect Against Interest Rate Hikes Multifamily Executive Magazine

Maximum Mortgage Tax Deduction Benefit Depends On Income

Interest Rate Cap What It Means For Arms Credible

Edexcel As Unit 1 Pdf Factors Of Production Economics

Mortgage Interest Deduction How It Works In 2022 Wsj

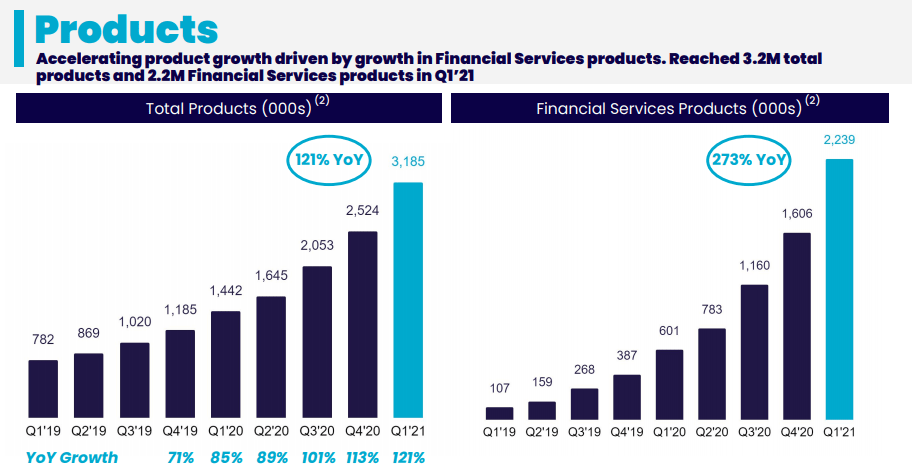

Sofi Technologies Stock A Next Generation Banking Disruptor Nasdaq Sofi Seeking Alpha

:max_bytes(150000):strip_icc()/GettyImages-1311546186-bcbce3839b544ec1b3115552c20b8b52.jpg)

Home Equity Loans And The Cap On Home Loan Tax Deductions

Roger That Newsletter February 2021 By Son Nguyen Issuu

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Interest Deduction Rules Limits For 2023